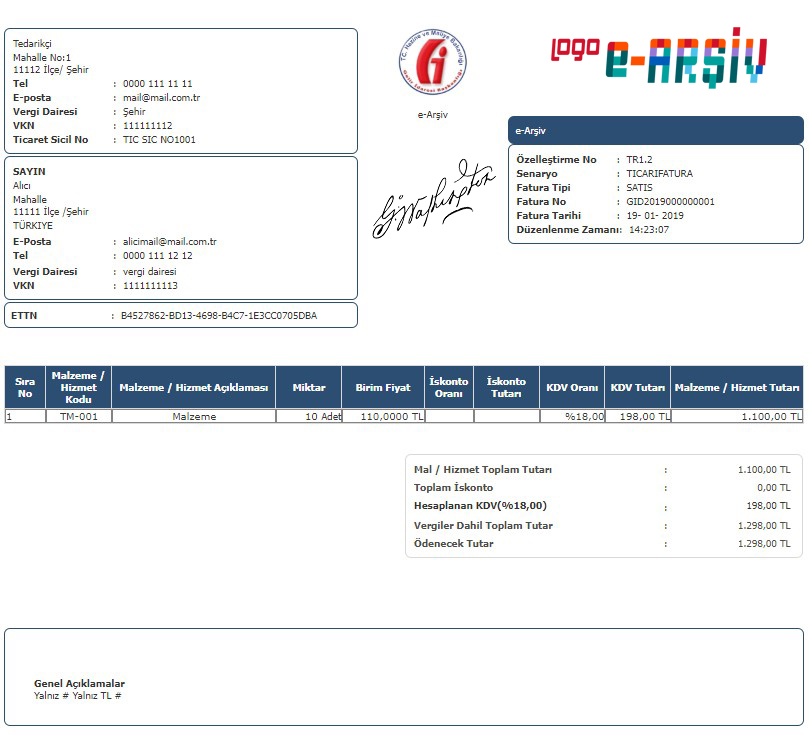

Logo e-Archive Invoice

Smart Choice for Taxpayers Logo e-Archive Invoice

Logo e-Archive Invoice is a digital solution that allows taxpayers to create and store their invoices digitally, eliminating the need for physical document archiving. This innovation offers a practical and effective solution for both goods and service providers and end consumers. All e-Invoices are reported to the Revenue Administration and there is a central mechanism for sending and receiving. The Revenue Administration oversees the e-Invoice process. e-Archive invoices are reported to the Revenue Administration, but this reporting is generally carried out by solution partners that provide e-archive invoice services.

One of the issues that should be taken into consideration when using e-Archive Invoice is that the reports are submitted to the Revenue Administration on time. These reports must be sent to the Revenue Administration by midnight of the day following the day the invoice is issued.

Advantages of e-Archive Invoice

When it comes to E-Archive Invoicing, using a dedicated integrator offers many different advantages:

Accessibility from anywhere, from any device: Private integrators use cloud technology to enable you to access your e-Archive Invoices from almost anywhere and on any device with an internet connection.

Easy editing and forwarding: You have the flexibility to edit your e-Archive Invoices whenever you want through the special integrator system. This streamlined process allows you to immediately deliver updated invoices to your buyers.

Efficient invoice acceptance or rejection: Custom integrators simplify the task of accepting or rejecting invoices through a single, user-friendly system.

Secure invoice storage for 10 years: With the special integrator, you can safely store your invoices for up to 10 years.

e Archive How to Cut an Invoice Logo

e Archive Invoice Logo is designed specifically for end users or customers and is often used by e-commerce businesses to send invoices via e-mail after purchase. Additionally, if you have collaborations with legal entities that do not use e-Invoice, you can send e-Archive invoices to them. You can easily create your e-Archive invoices by accessing the portal. This method is especially advantageous for small businesses with limited resources. An important advantage over e-Invoices is that they are valid as printed documents accepted by official institutions. These invoices are prepared in a free format, approved and stored with a financial seal and time stamp, ensuring compliance with legal regulations.

If you are already an e-Invoice taxpayer, it is very easy to switch to the e-Archive application. You can switch by applying via eLogo (siparis.elogo.com.tr), and you do not need to apply to the Revenue Administration. For those who are not yet e-Invoice taxpayers, the first step to benefit from the advantages of the e-Archive application is to switch to the e-Invoice system. After creating your e-Invoice obligation, you can benefit from the conveniences provided by the e-Archive application.

What is e-Archive?

e-Archive is an application that facilitates the analysis, storage, presentation and reporting of electronically, especially invoices recorded by the Revenue Administration. Essentially, it functions as a form of electronic invoicing that allows businesses to create and transmit invoices electronically to their customers. The use of e-Archive varies according to the standards set by the revenue administration and the relevant sector.

Although e-Archive and e-Invoice are often confused due to their visual similarities, they serve different purposes:

With e-Invoice, you can send invoices to your customers who are also e-Invoice users. E-Archive invoices are for customers who do not use e-Invoice. For example, you can issue an e-Archive invoice to a legal entity or an organization that has not switched to e-Invoice.

When using e-Archive invoice for electronic invoicing, you do not need to determine whether your customer is an e-Invoice user. The system detects this based on your customer's tax number and directs you accordingly. This means you can easily sell, create an electronic invoice and send it to your customer right away.

What are the Differences Between e-Invoice and e-Archive?

e-Invoice is an electronic invoice designed for companies that are taxpayers and allows electronic invoice exchange between companies. It is the digital representation of a paper invoice and is used primarily in business-to-business transactions. Although e-Archive Invoice is also an electronic invoice, it is intended for companies or end consumers who are not e-invoice taxpayers.

Although the use of e-Invoice may be mandatory in some regions or certain types of businesses, any company can switch to e-Invoice at its own discretion. In the past, e-Archive invoices were generally used in addition to e-Invoice, and companies had to first be included in the e-Invoice system. However, recent regulations allow e-archive invoices to be issued independently through private integrators, without the need to be an e-invoice user.

How to Cancel e Archive Invoice Logo

It may sometimes be necessary to cancel the e-Archive Invoice for various reasons. Fortunately, Logo e Archive Invoice cancellation is quite simple and follows similar procedures to a paper invoice. In accordance with the Tax Procedure Law, it offers objection, cancellation or refund processes similar to traditional paper invoices. In such cases, canceling your e-Archive Invoice only involves a few simple steps. After you send the invoice to the buyer, there is a certain period of time during which you can cancel the invoice if necessary. Likewise, the buyer has the right to object to the invoice and request its cancellation within the specified period after receiving the invoice.

When an individual customer wants to return the product he purchased, the process may require adhering to the return policies of the company from which the product was purchased. If the customer made an online purchase, they typically print out the invoice sent to them, fill out the required return information, and submit both the invoice and the product for processing.

If you cannot cancel your e-archive invoice within 7 days, you must create a return invoice through the Logo system and send it to the seller. After the buyer receives your return invoice, you can rearrange your e-archive invoice and forward it to the buyer. Invoices created through the e-Archive portal are initially stored in draft form, providing the flexibility to revise and cancel draft invoices as needed. However, invoices issued through the Revenue Administration Portal cannot be canceled after they are processed.

- ERP Solutions

- Logo Start 3

- Logo Go 3

- Logo Go Wings

- Logo Tiger 3

- Logo Tiger Wings

- e-Government Solutions

- Logo e-Invoice

- Logo e-Archive Invoice

- Logo e-Ledger

- Logo e-Delivery Note

- Logo e-Export Invoice

- eLogo

©2022 Binary Software Consulting. All rights reserved.